sacramento property tax rate

For property taxes via mail online or telephone. The Tax Collector urges customers to submit payment.

22959e8f 233f 46b0 A568 81a9f40bffc2 1920x1080 Jpg

The County only retains about 16 of the taxes we collect.

. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. While that is the rate a typical homeowner in the county pays its not necessarily what a. Property tax specialists are available by phone from 900 am.

Tax bill amounts due dates direct levy information delinquent prior year tax information and printable payment stubs are available on the Internet using your 14-digit parcel number at e. Welcome to e-PropTax Sacramento Countys Online Property Tax Bill Information System. If you have questions concerning the assessed value of your property or the validity of.

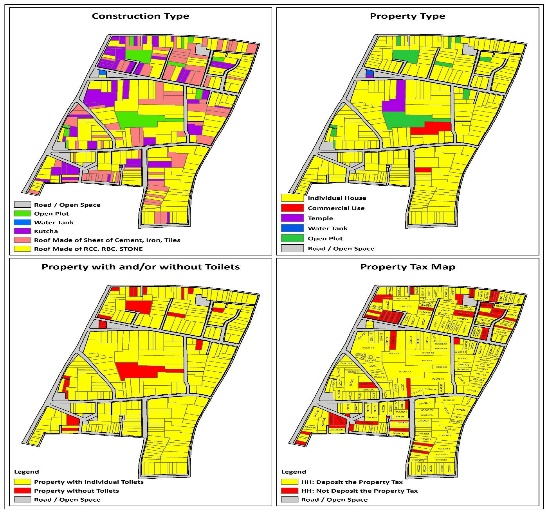

By locality a report of properties that are nearly equal in assessed market value is produced via an automated process. Sacramento County Assessors Office Services. By locale a report of properties that are nearly equal in assessed market value is assembled via an automated process.

The Sacramento County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within. Please make your Property tax payment by the due date as stated on the tax bill. To 400 pm Monday.

Who and How Determines Sacramento Property Tax Rates. Next a match of those properties tax billing amounts is undertaken. Tax Collection Specialists are.

You can use the California property tax map to the left to compare Sacramento Countys property tax to other counties in California. Marin County collects the highest property tax in. Those entities include Sacramento the county districts and special purpose units that produce that composite tax rate.

Under Proposition 13 the property tax rate is fixed at 1 of assessed value plus any assessment bond approved by popular vote. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Box 508 Sacramento CA 95812-0508.

These properties tax bills are then contrasted. Please make your Property tax payment by the due date as stated on the tax. For paper checks use the mailing address PO.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the. View the E-Prop-Tax page for more information. In the Countys situation property taxes are set by Proposition 13 Article 13 of the State Constitution.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000. If you have questions concerning the assessed value of your property or the validity of. Welcome to e-PropTax Sacramento Countys Online Property Tax Bill Information System.

The bulk of the taxes. A delinquency penalty will be charged at the close of the delinquency date. As a result of various assessment bonds property tax rates in.

View the E-Prop-Tax page for more information. The average effective property tax rate in Riverside County is 095 one of the highest in the state.

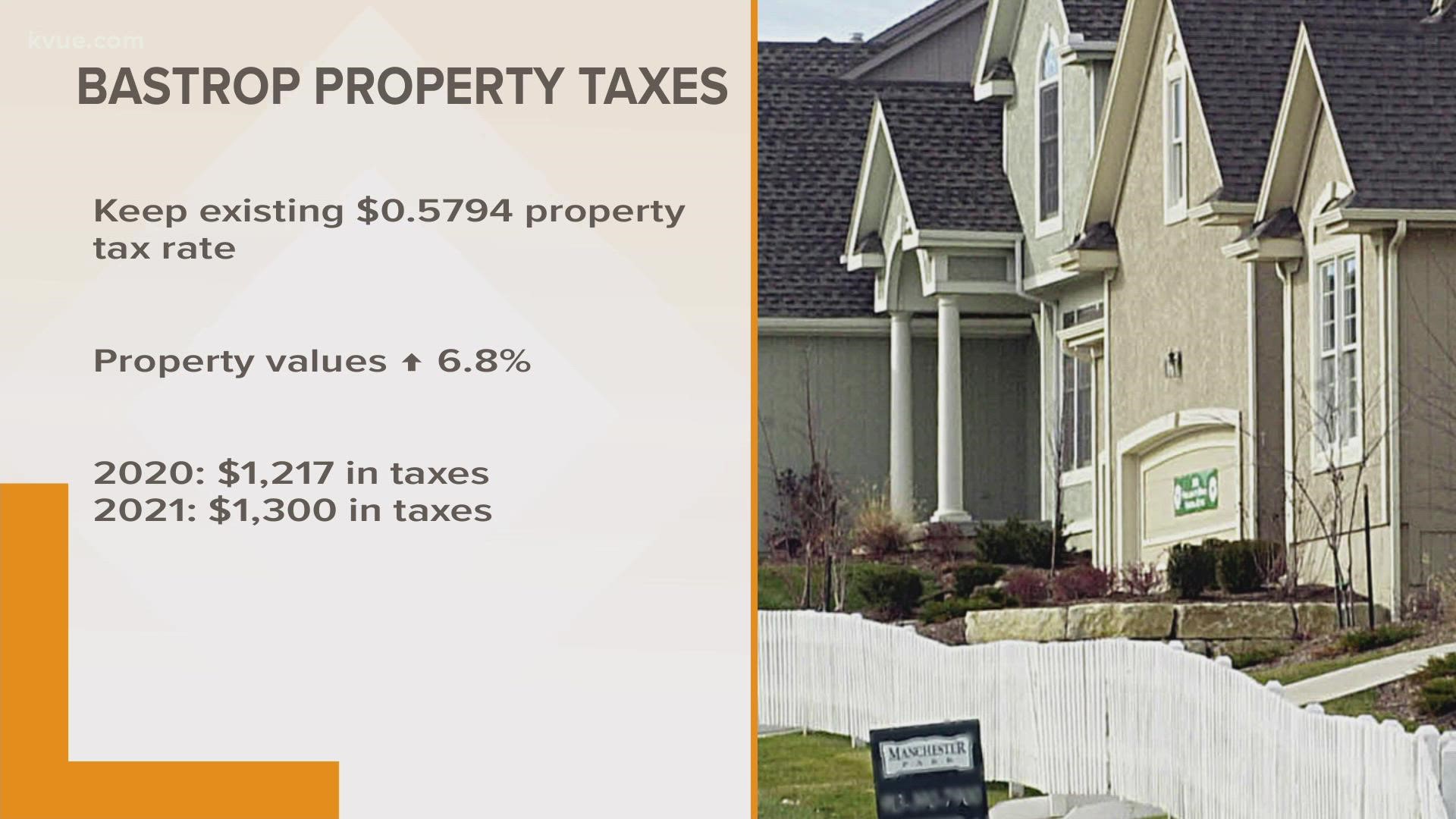

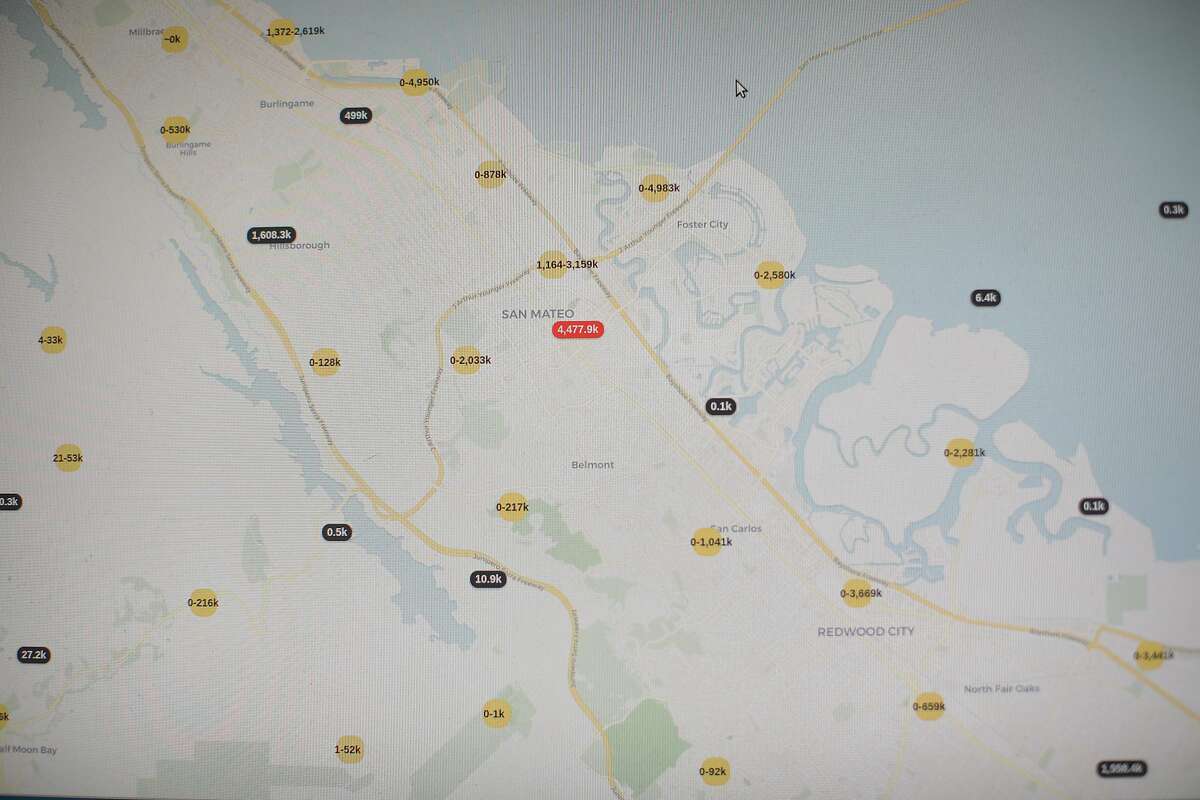

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

California Property Tax Calculator Smartasset

California S Losing Hand Why Economic Officials Say Big Employers Bypass Sacramento Sacramento Business Journal

What Happens If You Can T Pay Your Property Taxes

Tax Guide Best City To Buy Legal Weed In California Leafly

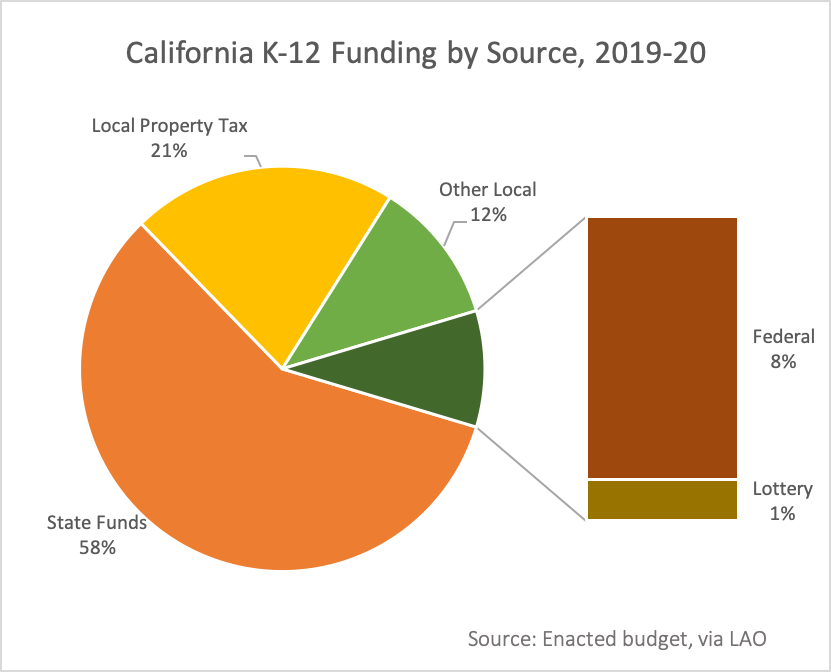

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Chicago Has The 2nd Highest Commercial Property Taxes Of Major U S Cities Wirepoints

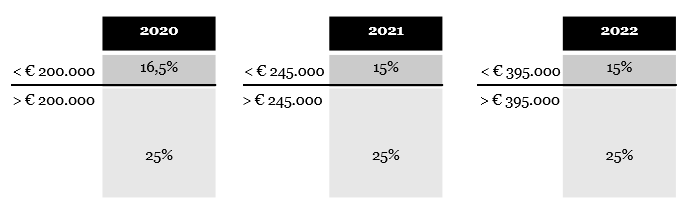

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Dubious Property Tax Appeals Are Costing L A County Millions Los Angeles Times

Perspectives Of Property Tax Incidence In California Forty Years After Proposition 13 Robert W Wassmer Professor Department Of Public Policy And Administration Ppt Download

Sacramento County Housing Indicators Firsttuesday Journal

Politifact Mostly True California S Taxes Are Among The Highest In The Nation

Property Tax California H R Block

Los Angeles County Ca Property Tax Search And Records Propertyshark